Are you looking for a fun and effective way to save money? Look no further than the 52 Week Money Saving Challenge! This challenge has gained popularity over the years, and with good reason. It’s a simple and manageable way to save a significant amount of money without feeling overwhelmed.

Here are 10 different ways to do the 52 Week Money Saving Challenge:

The first option is the traditional 52 Week Money Saving Challenge. You start by saving $1 on the first week, $2 on the second week, and so on, until you reach $52 on the last week. By the end of the 52 weeks, you will have saved a total of $1,378! It’s a great way to gradually increase your savings without feeling the pinch.

The first option is the traditional 52 Week Money Saving Challenge. You start by saving $1 on the first week, $2 on the second week, and so on, until you reach $52 on the last week. By the end of the 52 weeks, you will have saved a total of $1,378! It’s a great way to gradually increase your savings without feeling the pinch.

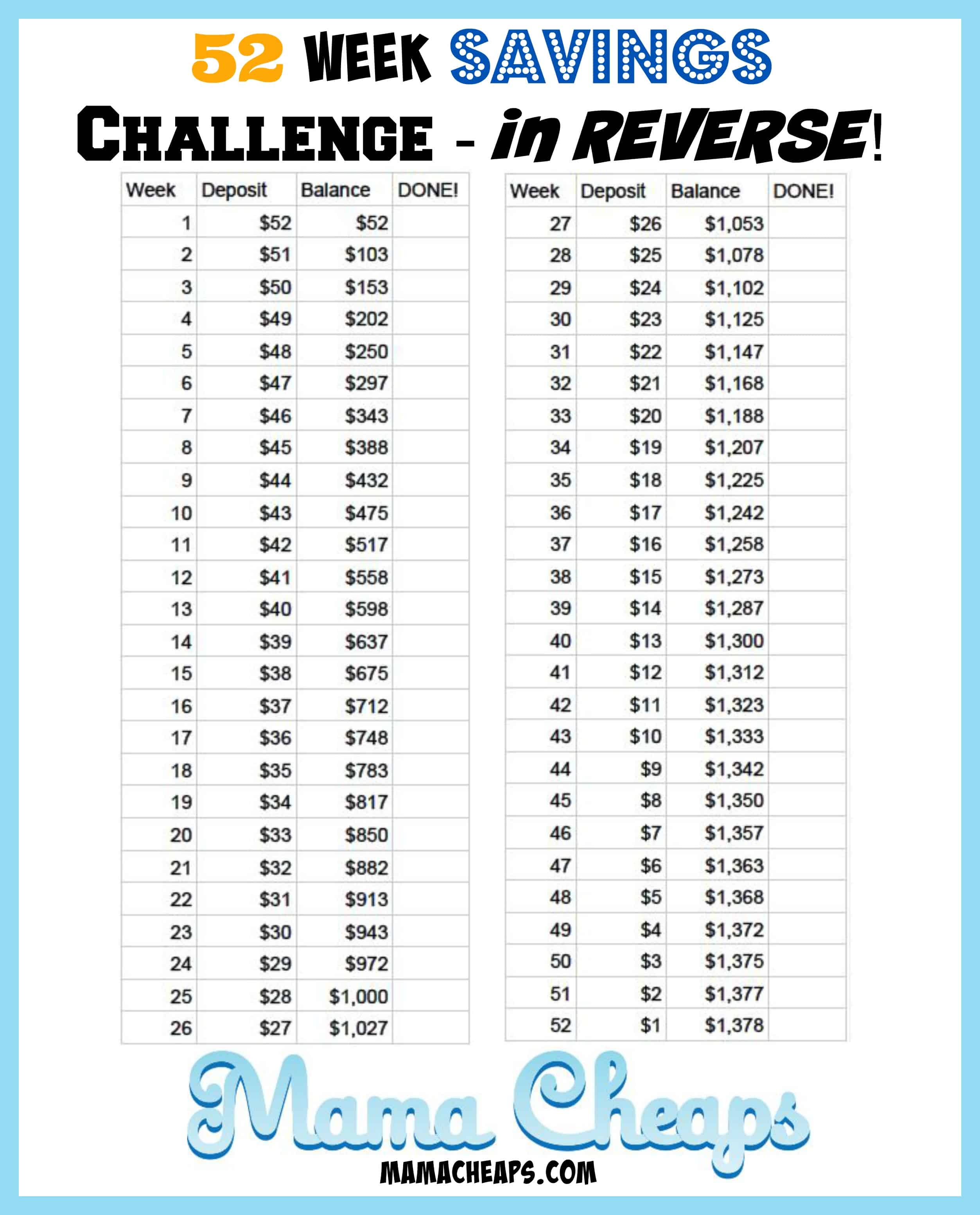

If you prefer to start with a larger amount and gradually decrease your savings, you can try the Reverse 52 Week Money Saving Challenge. You start by saving $52 on the first week, $51 on the second week, and so on, until you save $1 on the last week. This method allows you to save more in the earlier weeks when you may have more disposable income.

If you prefer to start with a larger amount and gradually decrease your savings, you can try the Reverse 52 Week Money Saving Challenge. You start by saving $52 on the first week, $51 on the second week, and so on, until you save $1 on the last week. This method allows you to save more in the earlier weeks when you may have more disposable income.

If you prefer a more predictable and consistent savings plan, you can try the Even 52 Week Money Saving Challenge. With this method, you save $26 every week for 52 weeks. By the end of the challenge, you would have saved a total of $1,352. It’s a great option if you prefer a steady savings plan.

If you prefer a more predictable and consistent savings plan, you can try the Even 52 Week Money Saving Challenge. With this method, you save $26 every week for 52 weeks. By the end of the challenge, you would have saved a total of $1,352. It’s a great option if you prefer a steady savings plan.

If you’re up for a challenge and want to save more, you can combine the Forward and Reverse 52 Week Money Saving Challenge. With this method, you save $1 on the first week, $2 on the second week, and so on, until you reach $52 on the 26th week. Then, you start decreasing your savings by $1 each week until you save $1 on the last week. This method allows you to save a total of $2,756! It’s a great way to challenge yourself and boost your savings.

If you’re up for a challenge and want to save more, you can combine the Forward and Reverse 52 Week Money Saving Challenge. With this method, you save $1 on the first week, $2 on the second week, and so on, until you reach $52 on the 26th week. Then, you start decreasing your savings by $1 each week until you save $1 on the last week. This method allows you to save a total of $2,756! It’s a great way to challenge yourself and boost your savings.

If you want to save even more money, you can try the Double 52 Week Money Saving Challenge. With this method, you save twice the amount of money each week compared to the traditional challenge. For example, you save $2 on the first week, $4 on the second week, and so on, until you save $104 on the last week. By the end of the 52 weeks, you would have saved a total of $2,756! It’s a great option if you’re looking to save more aggressively.

If you want to save even more money, you can try the Double 52 Week Money Saving Challenge. With this method, you save twice the amount of money each week compared to the traditional challenge. For example, you save $2 on the first week, $4 on the second week, and so on, until you save $104 on the last week. By the end of the 52 weeks, you would have saved a total of $2,756! It’s a great option if you’re looking to save more aggressively.

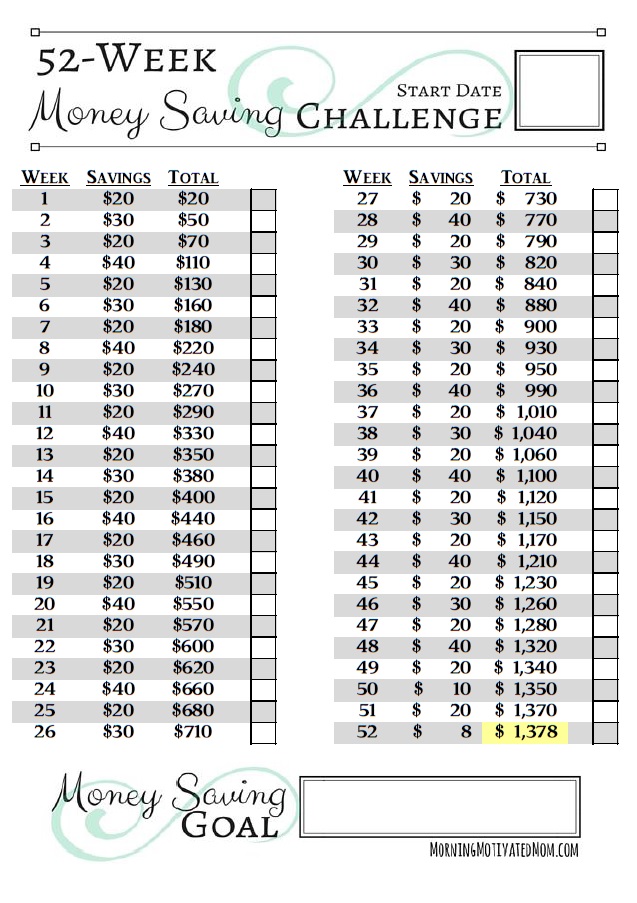

If you’re looking to save a specific amount of money, you can customize the 52 Week Money Saving Challenge to fit your financial goals. You can use a printable template and adjust the savings amount each week to reach your desired saving goal. Whether it’s $500, $1,000, or even $5,000, you can tailor the challenge to meet your needs.

If you’re looking to save a specific amount of money, you can customize the 52 Week Money Saving Challenge to fit your financial goals. You can use a printable template and adjust the savings amount each week to reach your desired saving goal. Whether it’s $500, $1,000, or even $5,000, you can tailor the challenge to meet your needs.

Another way to make the 52 Week Money Saving Challenge more fun and rewarding is to add a reward system. For example, you can treat yourself to a small reward every time you reach a savings milestone, such as every $100 saved. It can be anything from a spa day to a night out with friends. This will keep you motivated and excited about reaching your saving goals.

Another way to make the 52 Week Money Saving Challenge more fun and rewarding is to add a reward system. For example, you can treat yourself to a small reward every time you reach a savings milestone, such as every $100 saved. It can be anything from a spa day to a night out with friends. This will keep you motivated and excited about reaching your saving goals.

Remember, the most important thing is to find a savings method that works for you and your financial situation. Whether you choose the traditional challenge, the reverse challenge, or a customized version, the key is to stay committed and consistent with your savings. Start small and gradually increase your savings over time.

So what are you waiting for? Start the 52 Week Money Saving Challenge today and watch your savings grow!