Hey there! Are you familiar with the 1099 form? Well, if you’re not, no worries! I’m here to help you out. Let’s dive into what the 1099 form is all about and why it’s essential.

1099 Online Fillable Form - Printable Forms Free Online

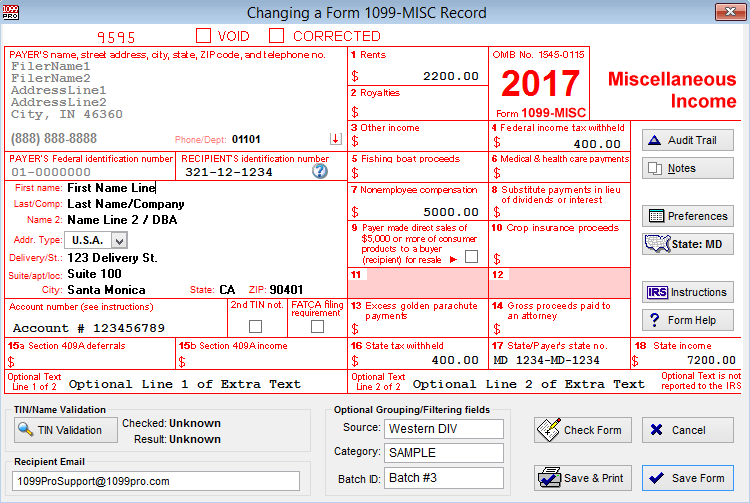

First of all, let me introduce you to the convenience of online fillable forms. Gone are the days of manually writing out forms! With this online fillable 1099 form, you can easily and seamlessly input all the necessary information. Save time, stay organized, and ensure accuracy, all with just a few clicks!

First of all, let me introduce you to the convenience of online fillable forms. Gone are the days of manually writing out forms! With this online fillable 1099 form, you can easily and seamlessly input all the necessary information. Save time, stay organized, and ensure accuracy, all with just a few clicks!

Nonemployee Compensation - Data is entered onto windows that resemble

The nonemployee compensation section of the 1099 form is especially crucial. Independent contractors, freelancers, and other self-employed individuals who receive income from clients will fall under this category. The data is entered onto windows that resemble online windows, making the process user-friendly and straightforward.

The nonemployee compensation section of the 1099 form is especially crucial. Independent contractors, freelancers, and other self-employed individuals who receive income from clients will fall under this category. The data is entered onto windows that resemble online windows, making the process user-friendly and straightforward.

1099-NEC Software | Print & eFile 1099-NEC Forms

Simplify your life with 1099-NEC software! Printing and e-filing your 1099-NEC forms has never been easier. Keep track of your records efficiently while saving time and effort. Take advantage of this handy tool to make your tax season a breeze.

Simplify your life with 1099-NEC software! Printing and e-filing your 1099-NEC forms has never been easier. Keep track of your records efficiently while saving time and effort. Take advantage of this handy tool to make your tax season a breeze.

2021 Form 1099-NEC Explained - YouTube

If you’re a visual learner, this YouTube video is perfect for you! Get a comprehensive explanation of the 2021 Form 1099-NEC. Clear up any confusion and gain a deeper understanding of the form’s purpose and nuances. Remember, knowledge is power!

If you’re a visual learner, this YouTube video is perfect for you! Get a comprehensive explanation of the 2021 Form 1099-NEC. Clear up any confusion and gain a deeper understanding of the form’s purpose and nuances. Remember, knowledge is power!

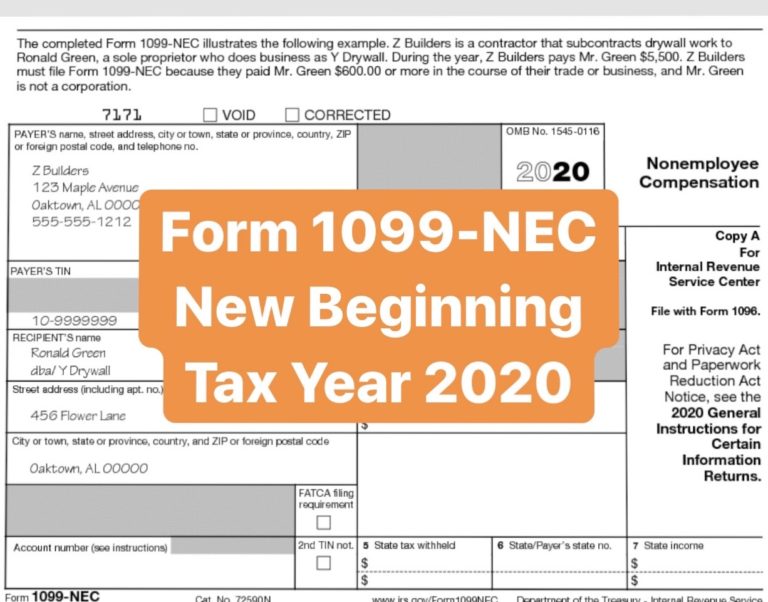

1099 Nec Form 2020 Printable - Printable World Holiday

Printable forms are always a convenient option. This 1099 Nec Form from 2020 brings you a sense of nostalgia with its printable format. Whether you prefer digital or physical copies, having the ability to print out forms gives you the flexibility you need.

Printable forms are always a convenient option. This 1099 Nec Form from 2020 brings you a sense of nostalgia with its printable format. Whether you prefer digital or physical copies, having the ability to print out forms gives you the flexibility you need.

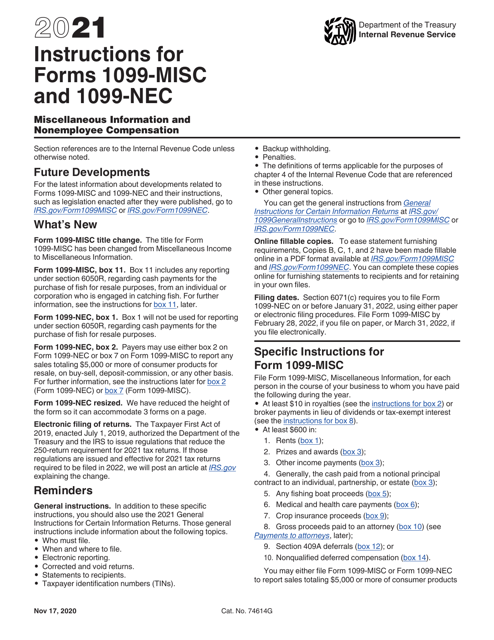

Instructions for Forms 1099-MISC and 1099-NEC (2021) | Internal Revenue

Don’t get overwhelmed by the forms! The Internal Revenue Service (IRS) provides comprehensive instructions for Forms 1099-MISC and 1099-NEC. Take the guesswork out of filling out these forms by referring to the official instructions. It’s always better to be well-informed!

Don’t get overwhelmed by the forms! The Internal Revenue Service (IRS) provides comprehensive instructions for Forms 1099-MISC and 1099-NEC. Take the guesswork out of filling out these forms by referring to the official instructions. It’s always better to be well-informed!

Download Instructions for IRS Form 1099-MISC, 1099-NEC PDF, 2021

Looking for a downloadable version of the instructions for IRS Form 1099-MISC and 1099-NEC? You’re in luck! Click on the link provided, and you’ll have the PDF version at your fingertips. Having a digital copy allows you to access the instructions whenever and wherever you need them.

Looking for a downloadable version of the instructions for IRS Form 1099-MISC and 1099-NEC? You’re in luck! Click on the link provided, and you’ll have the PDF version at your fingertips. Having a digital copy allows you to access the instructions whenever and wherever you need them.

Free 1099 Template Excel 2019

If you prefer using Excel, then this free 1099 template in Excel format from 2019 will be right up your alley. Easily input your information into a pre-formatted template and calculate your totals effortlessly. Excel provides a convenient option for those who love working with spreadsheets.

If you prefer using Excel, then this free 1099 template in Excel format from 2019 will be right up your alley. Easily input your information into a pre-formatted template and calculate your totals effortlessly. Excel provides a convenient option for those who love working with spreadsheets.

What is Form 1099-NEC for Nonemployee Compensation

Form 1099-NEC is specifically designed to report nonemployee compensation received throughout the year. As mentioned earlier, if you’re an independent contractor, freelancer, or self-employed individual, this is the form that concerns you. Make sure you understand the purpose and importance of this form for proper tax reporting.

Form 1099-NEC is specifically designed to report nonemployee compensation received throughout the year. As mentioned earlier, if you’re an independent contractor, freelancer, or self-employed individual, this is the form that concerns you. Make sure you understand the purpose and importance of this form for proper tax reporting.

TSP 2020 Form 1099-R Statements Should Be Examined Carefully

Finally, make sure to carefully examine your TSP 2020 Form 1099-R Statements. Accuracy is key when it comes to tax reporting, so be vigilant in reviewing your statements. If you come across any discrepancies or have any questions, don’t hesitate to reach out for clarification.

Finally, make sure to carefully examine your TSP 2020 Form 1099-R Statements. Accuracy is key when it comes to tax reporting, so be vigilant in reviewing your statements. If you come across any discrepancies or have any questions, don’t hesitate to reach out for clarification.

And there you have it! A comprehensive overview of various resources related to the 1099 form. Whether you prefer online fillable forms, printable formats, or even video explanations, there’s something here for everyone. Stay organized, stay informed, and make your tax filing process a smooth one!