Are you ready for tax season? One important form that you may need to be aware of is the 1099-NEC. This form is used to report nonemployee compensation, such as income earned from freelance work or independent contracting. It’s important to understand this form and its requirements to ensure that you are in compliance with tax laws.

Form 1099-NEC Overview

The 1099-NEC is a tax form that is used to report income earned by nonemployees. It is different from the 1099-MISC form, which was previously used to report nonemployee compensation. Starting in tax year 2020, the IRS reintroduced the 1099-NEC form to separate nonemployee compensation from other types of income reported on the 1099-MISC form.

The 1099-NEC form is important for both businesses and individuals who pay nonemployees for their services. As a payer, you are required to provide a copy of this form to the recipient and file it with the IRS. The recipient then uses the information on the form to report their income on their personal tax return.

The 1099-NEC form is important for both businesses and individuals who pay nonemployees for their services. As a payer, you are required to provide a copy of this form to the recipient and file it with the IRS. The recipient then uses the information on the form to report their income on their personal tax return.

Changes for 2020

If you are familiar with the previous tax form, the 1099-MISC, you may be wondering what changes have been made for the 1099-NEC. The most significant change is the separation of nonemployee compensation onto its own form. This allows for clearer reporting and streamlines the process for both payers and recipients.

Another change is the deadline for filing the 1099-NEC form. The deadline for both providing a copy to the recipient and filing with the IRS is January 31st. This aligns with the deadline for providing W-2 forms to employees and helps ensure timely reporting of income.

Another change is the deadline for filing the 1099-NEC form. The deadline for both providing a copy to the recipient and filing with the IRS is January 31st. This aligns with the deadline for providing W-2 forms to employees and helps ensure timely reporting of income.

Filing the 1099-NEC

Filing the 1099-NEC form is relatively straightforward. As a payer, you will need to gather the necessary information, including the recipient’s name, address, and Social Security Number or Employer Identification Number. You will also need to determine the total amount of nonemployee compensation paid to each recipient during the tax year.

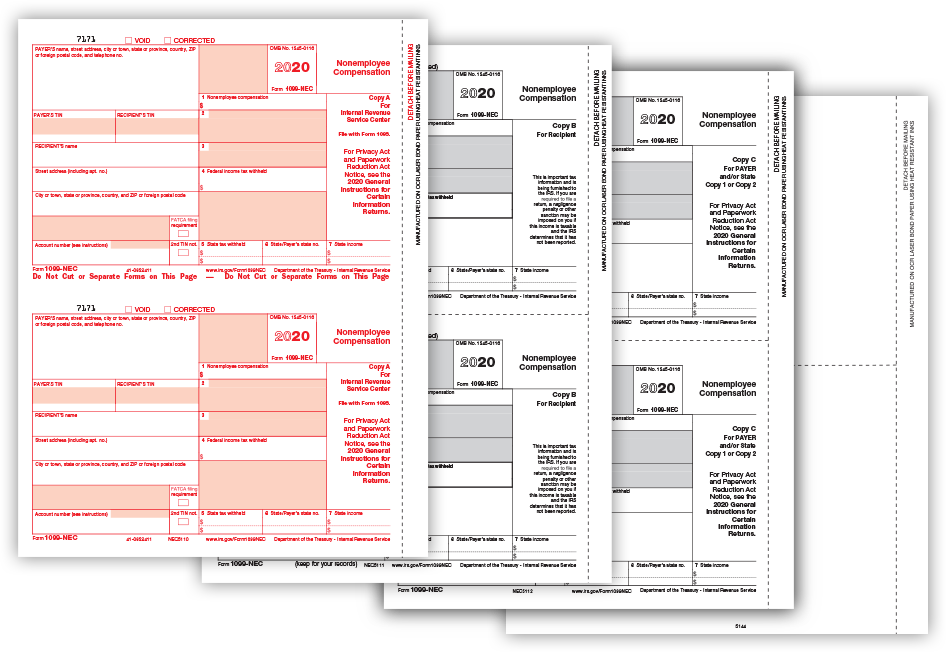

Once you have collected this information, you can fill out the 1099-NEC form. There are several copies of the form that you will need to distribute. Copy A is filed with the IRS, while Copy B is provided to the recipient. Additionally, there may be state-specific copies required, depending on the recipient’s location.

Once you have collected this information, you can fill out the 1099-NEC form. There are several copies of the form that you will need to distribute. Copy A is filed with the IRS, while Copy B is provided to the recipient. Additionally, there may be state-specific copies required, depending on the recipient’s location.

Importance of Accuracy

Accuracy is crucial when filling out the 1099-NEC form. Any errors or discrepancies can lead to penalties or delays in processing. It’s essential to double-check all information before submitting the form to the IRS and providing a copy to the recipient.

In addition to ensuring accuracy, it’s important to keep thorough records of all forms issued. This includes maintaining copies of the filed forms and any supporting documentation that may be required.

In addition to ensuring accuracy, it’s important to keep thorough records of all forms issued. This includes maintaining copies of the filed forms and any supporting documentation that may be required.

Conclusion

The 1099-NEC form is an important tool for reporting nonemployee compensation. As a payer, it is your responsibility to provide this form to the recipient and file it with the IRS. Understanding the requirements of this form and staying up to date on any changes is vital to ensuring compliance with tax laws.

As tax season approaches, be sure to familiarize yourself with the 1099-NEC and gather all the necessary information to complete the form accurately. By doing so, you can avoid penalties and delays and ensure a smooth tax filing process for both your business and the recipients of nonemployee compensation.

Remember, if you have any questions or concerns about the 1099-NEC form or any other tax-related matters, it’s always a good idea to consult with a tax professional or accountant who can provide guidance and support.

Remember, if you have any questions or concerns about the 1099-NEC form or any other tax-related matters, it’s always a good idea to consult with a tax professional or accountant who can provide guidance and support.