A W-9 form is an important document that businesses and individuals use to collect taxpayer information. It is commonly used for tax purposes, such as reporting income to the IRS and filing 1099 forms. This form helps businesses ensure that they have accurate information about their vendors and contractors so that they can correctly report payments made to them.

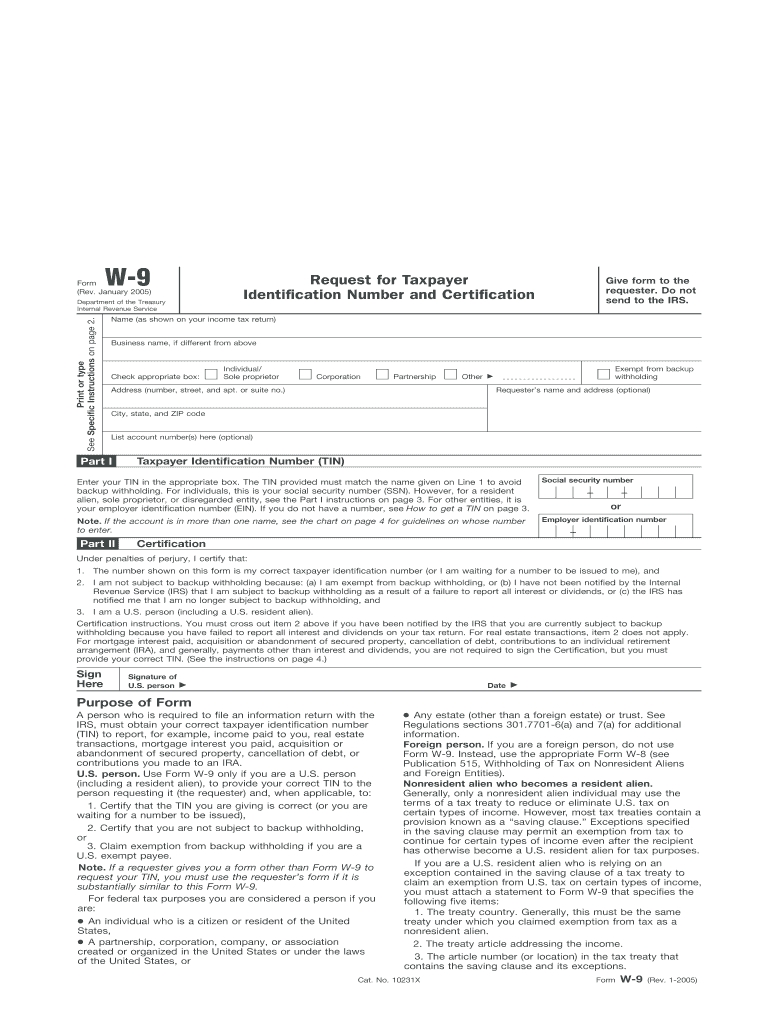

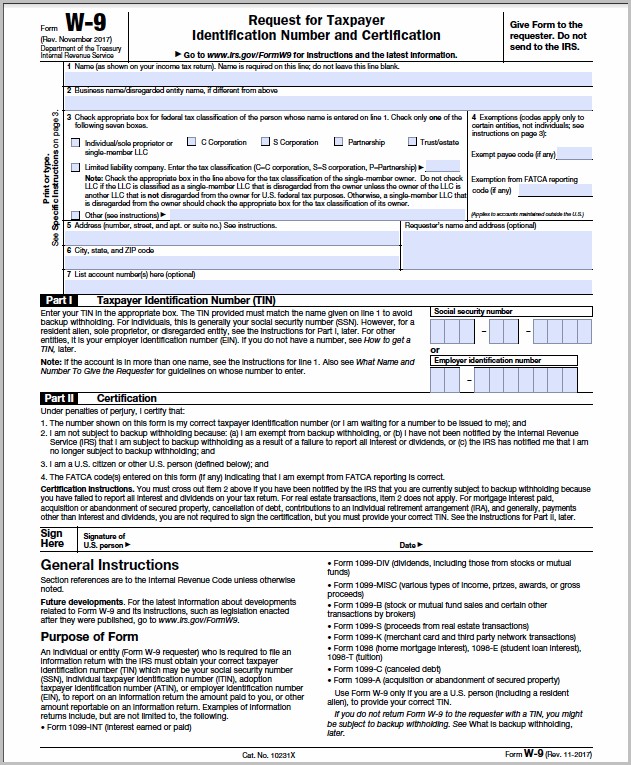

Blank W9 Form

The blank W9 form is a printable document that individuals or businesses can fill out with their taxpayer information. It is important to complete this form accurately and provide all the necessary information requested. This includes your legal name, business name (if applicable), address, and taxpayer identification number (TIN), which is often your Social Security Number (SSN) or Employer Identification Number (EIN).

The blank W9 form is a printable document that individuals or businesses can fill out with their taxpayer information. It is important to complete this form accurately and provide all the necessary information requested. This includes your legal name, business name (if applicable), address, and taxpayer identification number (TIN), which is often your Social Security Number (SSN) or Employer Identification Number (EIN).

Printable Blank W9 Form

The printable blank W9 form allows individuals or businesses to easily access and print a blank W9 form. This can be helpful if you prefer to fill out the form manually rather than electronically. By having a physical copy on hand, you can fill it out at your convenience and have a record of the information you provided.

The printable blank W9 form allows individuals or businesses to easily access and print a blank W9 form. This can be helpful if you prefer to fill out the form manually rather than electronically. By having a physical copy on hand, you can fill it out at your convenience and have a record of the information you provided.

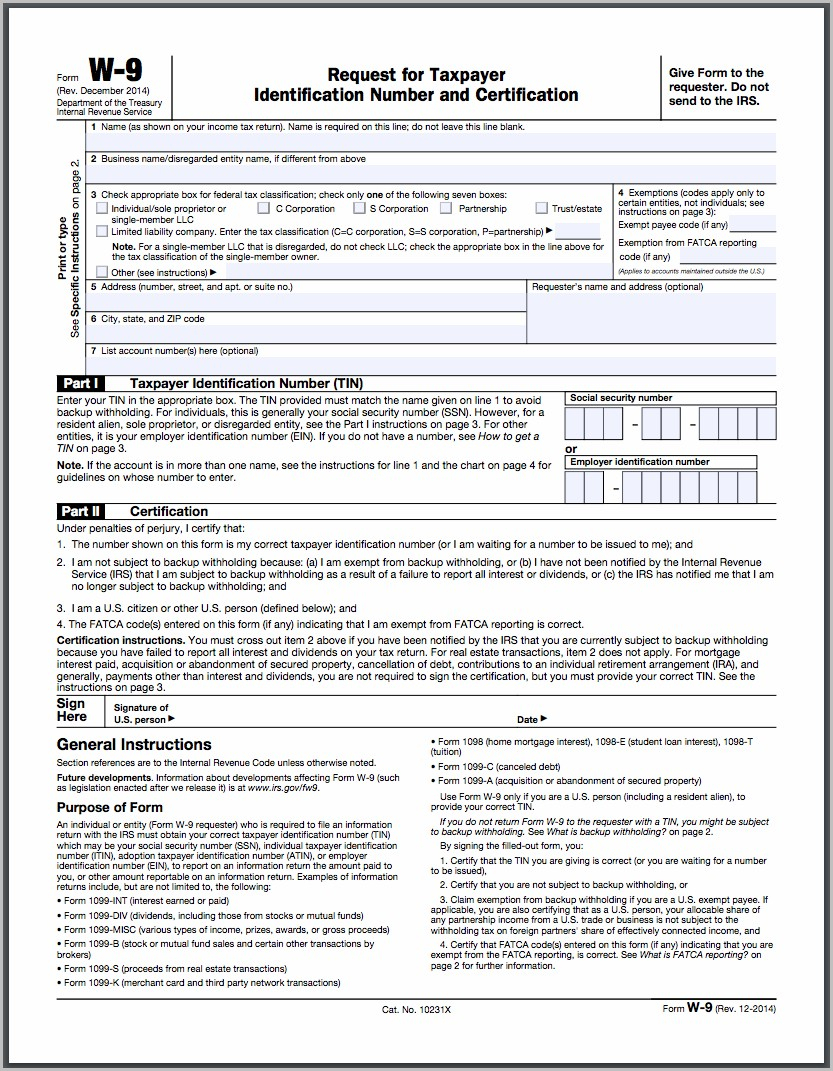

Printable Blank W 9 Forms Pdf

If you prefer a PDF format, the printable blank W 9 forms in PDF can be convenient. You can easily download and print the form from various sources. This allows you to have a hard copy that you can fill out by hand or fill out electronically and then print for submission.

If you prefer a PDF format, the printable blank W 9 forms in PDF can be convenient. You can easily download and print the form from various sources. This allows you to have a hard copy that you can fill out by hand or fill out electronically and then print for submission.

Printable W9 Form

The printable W9 form, available on W9Form.net, is an easy-to-use form that follows the IRS guidelines. It provides a clear layout with instructions on how to fill out each section. By using this printable form, you can ensure that you are completing the W9 form accurately and in compliance with IRS requirements.

The printable W9 form, available on W9Form.net, is an easy-to-use form that follows the IRS guidelines. It provides a clear layout with instructions on how to fill out each section. By using this printable form, you can ensure that you are completing the W9 form accurately and in compliance with IRS requirements.

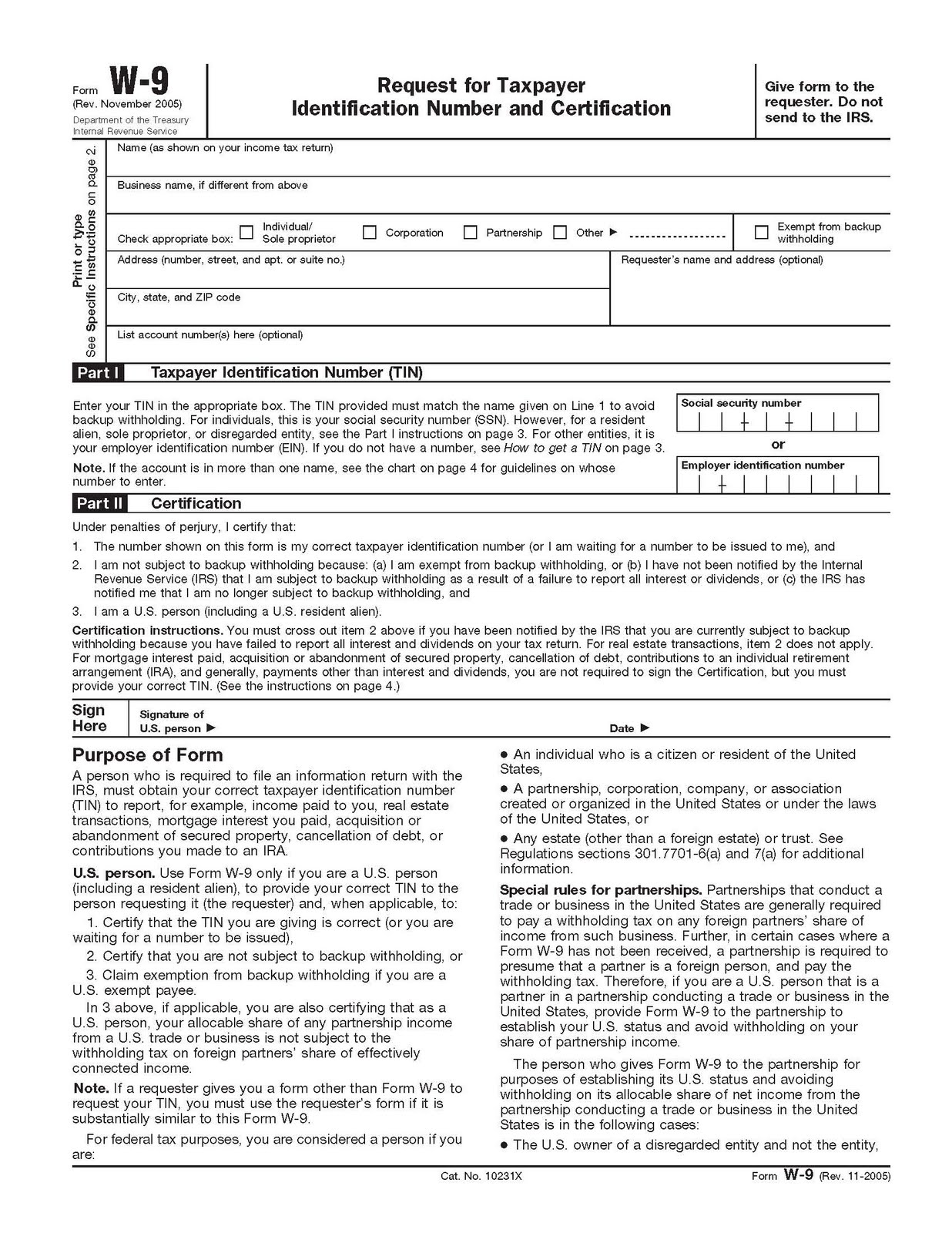

Irs Blank W 9 Form 2020 Printable

The IRS blank W 9 form for 2020 is a printable form that individuals or businesses can use to submit their taxpayer information. It is essential to keep up to date with the latest form versions provided by the IRS to ensure compliance with tax regulations.

The IRS blank W 9 form for 2020 is a printable form that individuals or businesses can use to submit their taxpayer information. It is essential to keep up to date with the latest form versions provided by the IRS to ensure compliance with tax regulations.

Irs W 9 Form Printable 2022

The IRS W 9 form printable for 2022 is another version of the W9 form that individuals or businesses can use to provide their taxpayer information. It is crucial to use the most recent version of the form to ensure accuracy and compliance with IRS requirements.

The IRS W 9 form printable for 2022 is another version of the W9 form that individuals or businesses can use to provide their taxpayer information. It is crucial to use the most recent version of the form to ensure accuracy and compliance with IRS requirements.

Fillable W 9 Form Pdf Form

The fillable W 9 form in PDF format provides a convenient way to fill out the form electronically. With this version, you can type directly into the form fields using a PDF reader or editing software. This enables you to easily update and make changes before printing or submitting the form.

The fillable W 9 form in PDF format provides a convenient way to fill out the form electronically. With this version, you can type directly into the form fields using a PDF reader or editing software. This enables you to easily update and make changes before printing or submitting the form.

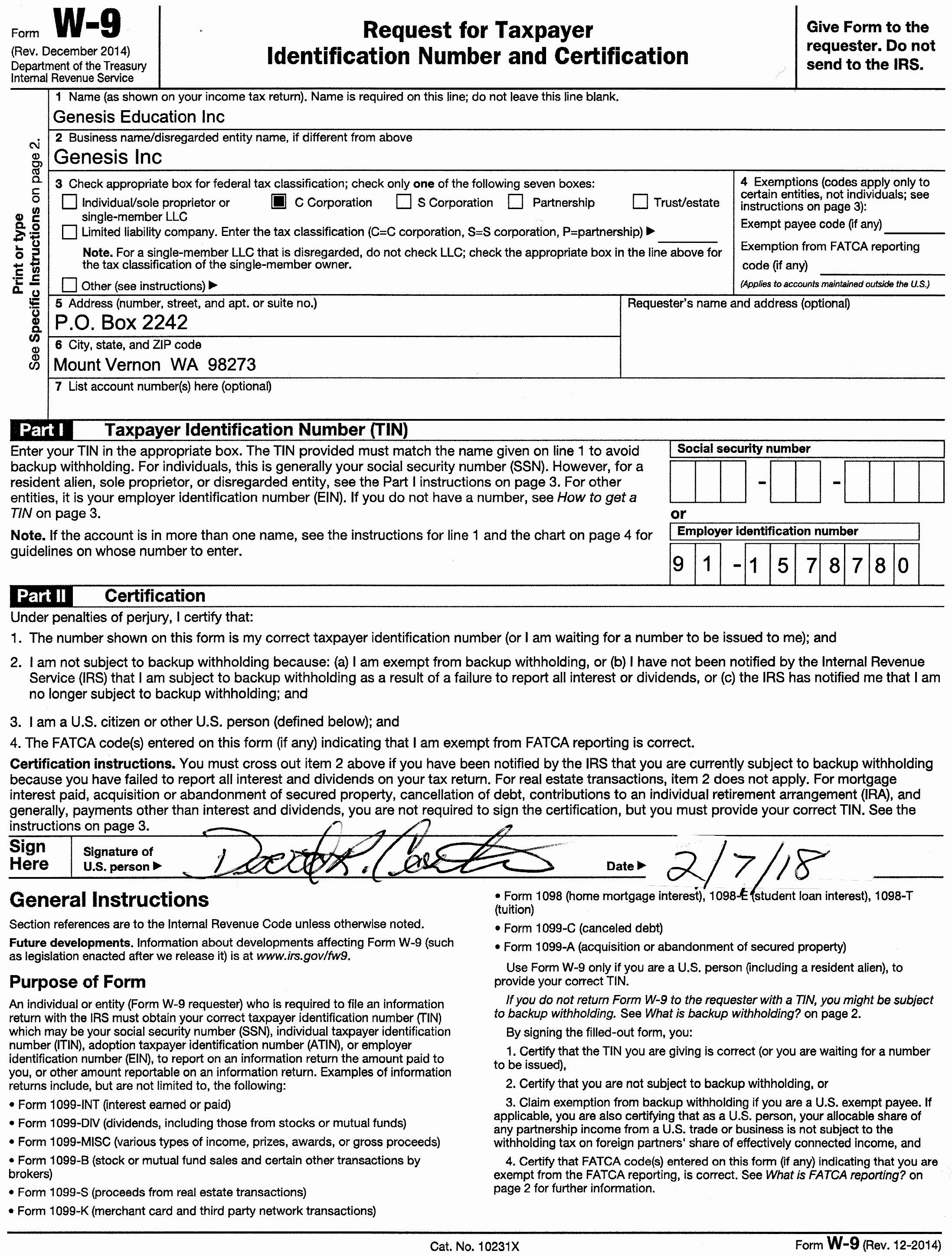

Blank W-9 Form | White Gold

The blank W-9 form featured here has a simple and clean design, making it easy to read and complete. It provides a streamlined layout that guides you through each section, ensuring you provide accurate and complete taxpayer information. This form is commonly used by businesses, contractors, and freelancers for tax reporting purposes.

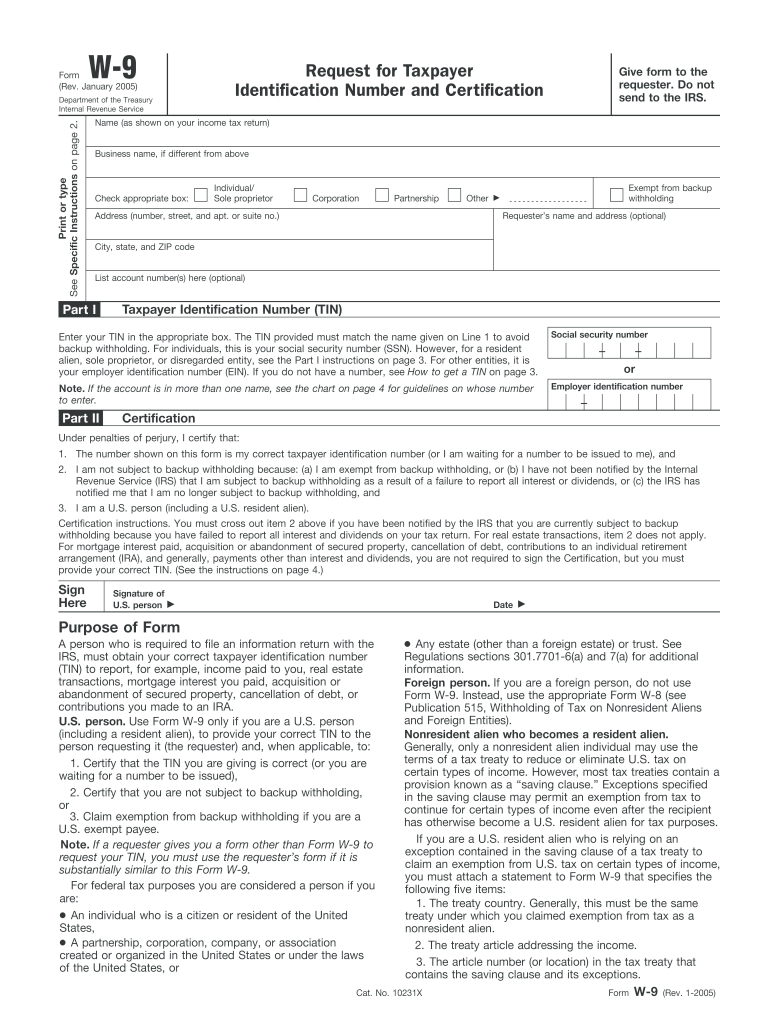

Printable W 9 Form - Fill Online, Printable, Fillable, Blank

The printable W 9 form from pdfFiller allows you to fill out the form online, making it even more convenient. This eliminates the need for printing and handwriting the form, as you can type your information directly into the editable fields. Once completed, you can save and download the form or submit it electronically.

The printable W 9 form from pdfFiller allows you to fill out the form online, making it even more convenient. This eliminates the need for printing and handwriting the form, as you can type your information directly into the editable fields. Once completed, you can save and download the form or submit it electronically.

In conclusion, the availability of various printable and fillable W-9 forms provides individuals and businesses with convenient options for submitting taxpayer information accurately. Whether you prefer a printed form that you can fill out manually or an electronic version that allows you to type your information, these resources ensure compliance with tax regulations and facilitate efficient tax reporting.