Are you feeling overwhelmed with tax season approaching? Don’t worry, we’ve got you covered! We understand that organizing your taxes can be a daunting task, but with the help of a printable tax planner, you’ll be well on your way to staying organized and stress-free.

How to Organize Your Taxes with a Printable Tax Planner

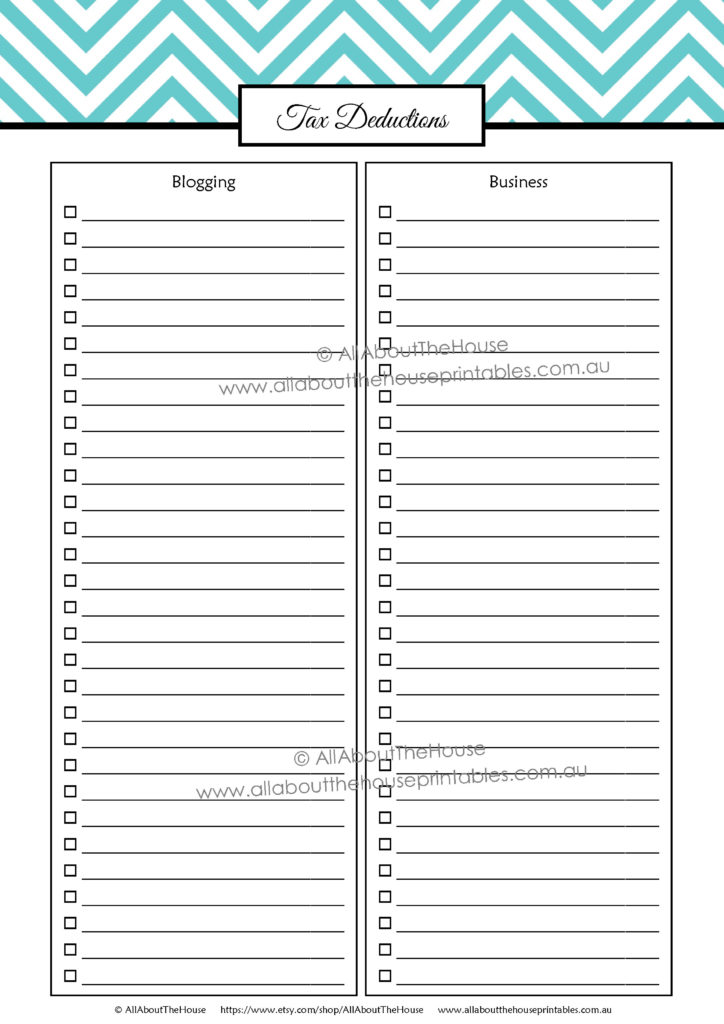

One of the best tools you can use to simplify the tax filing process is a printable tax planner. This planner provides a comprehensive checklist of tax deductions and expenses that are applicable to various areas such as business blogging, direct sales, and work expenses. By following this step-by-step guide, you can ensure that you are maximizing your deductions and minimizing your tax liability.

One of the best tools you can use to simplify the tax filing process is a printable tax planner. This planner provides a comprehensive checklist of tax deductions and expenses that are applicable to various areas such as business blogging, direct sales, and work expenses. By following this step-by-step guide, you can ensure that you are maximizing your deductions and minimizing your tax liability.

Self Employed Tax Deductions Worksheet

If you are self-employed, it is crucial to keep track of your expenses and deductions. This self-employed tax deductions worksheet is a helpful tool to assist you in gathering all the necessary information. It allows you to categorize your expenses and calculate your total deductions, ensuring that you are accurately claiming all eligible deductions.

If you are self-employed, it is crucial to keep track of your expenses and deductions. This self-employed tax deductions worksheet is a helpful tool to assist you in gathering all the necessary information. It allows you to categorize your expenses and calculate your total deductions, ensuring that you are accurately claiming all eligible deductions.

Tax Deduction Worksheet for Small Business

Small business owners often have a wide range of expenses that can be deducted from their taxes. This tax deduction worksheet for small business provides a detailed breakdown of various deductible expenses. By filling out this worksheet, you can keep track of your business expenses and ensure that you are taking advantage of all available deductions.

Small business owners often have a wide range of expenses that can be deducted from their taxes. This tax deduction worksheet for small business provides a detailed breakdown of various deductible expenses. By filling out this worksheet, you can keep track of your business expenses and ensure that you are taking advantage of all available deductions.

Tax Deduction Worksheet

No matter the size of your business, it is important to keep accurate records of your expenses. This tax deduction worksheet serves as a helpful tool to help you track your business expenses and maximize your deductions. By utilizing this worksheet, you can ensure that you are properly organizing your tax documents and claiming all eligible deductions.

No matter the size of your business, it is important to keep accurate records of your expenses. This tax deduction worksheet serves as a helpful tool to help you track your business expenses and maximize your deductions. By utilizing this worksheet, you can ensure that you are properly organizing your tax documents and claiming all eligible deductions.

Itemized Deductions Worksheet 2018

To itemize deductions, you need to have a thorough understanding of your eligible deductions. This itemized deductions worksheet for 2018 provides a clear breakdown of the various deductions that you may be eligible for. By utilizing this worksheet, you can document each deduction and ensure that you are not missing out on any potential tax savings.

To itemize deductions, you need to have a thorough understanding of your eligible deductions. This itemized deductions worksheet for 2018 provides a clear breakdown of the various deductions that you may be eligible for. By utilizing this worksheet, you can document each deduction and ensure that you are not missing out on any potential tax savings.

Landscaping Business Tax Deductions

If you are in the landscaping business, it’s important to understand the specific tax deductions that are applicable to your industry. This worksheet provides a comprehensive list of tax deductions that are specific to the landscaping business. By utilizing this worksheet, you can ensure that you are claiming all eligible deductions and maximizing your tax savings.

If you are in the landscaping business, it’s important to understand the specific tax deductions that are applicable to your industry. This worksheet provides a comprehensive list of tax deductions that are specific to the landscaping business. By utilizing this worksheet, you can ensure that you are claiming all eligible deductions and maximizing your tax savings.

Remember, tax season doesn’t have to be stressful. By utilizing these helpful tools and worksheets, you can easily organize your taxes and ensure that you are taking advantage of all eligible deductions. So, grab your printable tax planner and get started on simplifying your tax filing process today!